Gold and Interest Rates

In general, the price of gold rises when real interest rates are falling and the price of gold falls when real interest rates rise. If you put a bar of gold in the bank, it will weigh exactly the same when you take it out. If you put cash in the bank, however, you can earn interest and have more money when you withdraw it. So gaining interest seems like the logical choice. But it's not so simple. What if you earn 6% on your money sitting in the bank but meanwhile average prices have gone up 8%? When you take your money out of the bank you will have more money but you can buy less stuff with it. If the interest rate is 6% but inflation is 8% then the REAL interest rate earned by your money in the bank is -2%. In that case you would have been better off with a bar of gold sitting in the bank rather than the cash.

This is why gold tends to go up when real interest rates are going down. But how do you know the REAL interest rate? The real interest is the nominal interest rate (the rate of interest that is named or quoted, like the 'prime rate') minus the EXPECTED rate of inflation. No one can predict the future so no one knows for certain what the rate of inflation is going to be. However, we can see what market forces are expecting the rate of inflation to be. And this expectation is what counts because it is what prices are based on.

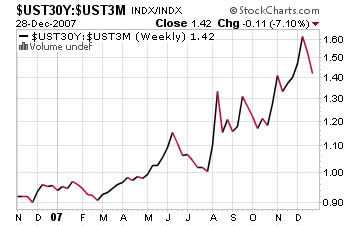

A comparison between long term and short term interest rates indicates whether the expected future interest rates are rising or falling. The 30-year Treasury Bond yield is determined by future expectatons. The 3-month Treasury Bill yield on the other hand closely follows the prime rate and is little influenced by expected inflation. Now recall that gold goes up when the REAL interest rate is falling. Again, the real interest rate is the nominal interest minus the expected rate of inflation. So if inflation is rising, that is the yield of the 30-year T-Bond is increasing relative to the 3-month T-Bill, then the real interest rate is falling. Inflation rises, real interest falls. Rising inflation means a smaller real return on money sitting in the bank. The long-term bond yield is an inflation indicator. It doesn't matter how high or low the rate actually is, only it's direction. If we chart the ratio between the 30-year T-Bond and the 3-month T-Bill we can see the changes in direction.

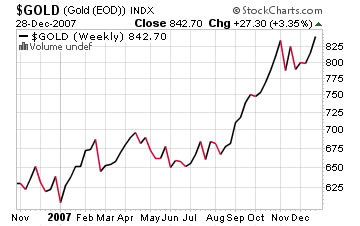

A rising ratio means that inflation expectations are rising and that gold is likely to be a better investment than cash, so the price of gold generally follows the same pattern:

There are however many factors influencing the price of gold besides interest rates. Geopolitics, the world economy, regional conflicts, even jewelry demand effects the price of gold. In fact, gold is more highly correlated with the value of the dollar than with real interest rates. But if you have a good idea of the direction interest rates are heading, you can use that information do help with your gold investment decisions.

Site Map

Site Map